In a spectacular display of its dominance in the technology sector, Nvidia, the graphics chip giant, has shattered already sky-high expectations with its second-quarter earnings report. The company’s remarkable performance not only defied predictions but sent shockwaves through the market, resulting in a surge in its stock value. Let’s dive into the details of Nvidia’s extraordinary achievement and the factors that propelled it to new heights.

A Record-Breaking Quarter

Surpassing Revenue Projections

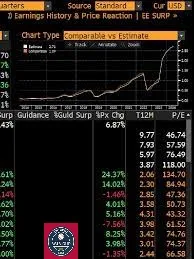

Nvidia’s Q2 earnings report showcased a staggering achievement – a 101% leap in revenue, reaching an impressive $13.51 billion. This colossal jump, compared to the previous year’s numbers, is a testament to the company’s unwavering dedication and strategic prowess. The technology giant’s ability to consistently innovate and capture market demand has undoubtedly contributed to its resounding success.

Earnings that Defy Gravity

The astonishing surge wasn’t limited to revenue alone. Nvidia’s adjusted earnings per share (EPS) also shattered expectations, boasting a remarkable 429% increase from the previous year, with EPS at $2.70. These figures far outperformed the projections of industry analysts and financial experts, who had initially anticipated EPS to be around $2.07.

The Power of AI and Market Response

AI as the Driving Force

At the heart of Nvidia’s meteoric rise lies the power of Artificial Intelligence (AI). The company’s strategic focus on accelerated computing and generative AI has positioned it as a frontrunner in the ongoing technological revolution. Nvidia’s CEO, Jensen Huang, aptly captured the essence of this transformation, declaring that “A new computing era has begun.”

Market Reaction and Record Stock Price

Investors were quick to respond to Nvidia’s extraordinary performance. The company’s stock surged by an astonishing 9% in after-hours trading, rocketing to a historic peak of $515 per share. This unprecedented surge showcases the market’s recognition of Nvidia’s accomplishments and its potential to reshape the technological landscape.

Diving Deeper into the Numbers

Segmental Performance

Nvidia’s report laid bare the company’s achievements in different segments. The data center division reported $10.3 billion in revenue, surpassing expectations of $8 billion. Simultaneously, the gaming segment raked in $2.5 billion in revenues, outperforming estimates of $2.4 billion. These figures underscore Nvidia’s prowess across diverse technology domains and its ability to capture varied market demands.

Strategic Repurchase Plan

As a testament to its confidence in future growth, Nvidia unveiled a strategic move – a $25 billion share repurchase plan. This announcement, combined with the exceptional earnings report, further boosted investor sentiment and solidified the company’s position as an industry leader.

Ripple Effects and the Broader AI Landscape

Snowflake’s Synergy

Nvidia’s extraordinary performance had a ripple effect on the technology sector. Snowflake, a software giant, also reported earnings that surpassed expectations, contributing to the upward momentum of AI-related stocks. Companies like C3.ai, Palantir, Marvell Technology, and MongoDB all experienced significant post-market trade surges, further exemplifying the widespread impact of Nvidia’s success.

Nvidia’s Influence on Generative AI

Nvidia’s success narrative has bolstered the entire generative AI landscape. Tech giants like Microsoft, Google, and Meta have been spurred to invest in their own generative AI tools and software. The launch of OpenAI’s ChatGPT in November 2022, which quickly became one of the fastest-growing apps in history, marked a turning point in the adoption of AI technologies.

Navigating Future Prospects

A Bright Horizon

Nvidia’s groundbreaking performance in Q2 2023 underscores the company’s dedication to pushing the boundaries of technology. The impressive financials and strategic initiatives lay a solid foundation for future growth, positioning Nvidia as a driving force in the AI revolution.

Challenges and Collaborations

However, the rapid increase in demand for Nvidia’s chips poses challenges related to production capacity. This has led to questions about whether key supplier TSMC can keep up with the demand for Nvidia’s graphics processors. Collaborations and strategic partnerships will play a crucial role in addressing this challenge.

Conclusion

In conclusion, Nvidia’s remarkable earnings report for Q2 2023 has propelled the company to unprecedented heights, capturing the essence of a new computing era driven by AI. The record-breaking revenue, astounding EPS growth, and market response underscore Nvidia’s pivotal role in shaping the technology landscape. As other tech giants join the AI revolution, Nvidia’s accomplishments serve as a beacon of innovation, reshaping industries and the way we interact with technology.

FAQs

- What led to Nvidia’s exceptional Q2 performance? Nvidia’s dedication to accelerated computing and generative AI, coupled with robust demand in data center and gaming segments, fueled its remarkable Q2 performance.

- How did Nvidia’s stock react to the earnings report? Nvidia’s stock surged by 9% in after-hours trading, reaching an all-time high of $515 per share.

- What impact did Nvidia’s success have on other companies? Nvidia’s success had a positive impact on AI-related stocks like C3.ai, Palantir, Marvell Technology, and MongoDB, which experienced significant post-market trade surges.

- What is the significance of Nvidia’s strategic repurchase plan? Nvidia’s $25 billion share repurchase plan demonstrates the company’s confidence in its future growth prospects and further boosted investor sentiment.

- How has Nvidia influenced the broader AI landscape? Nvidia’s success has catalyzed other tech giants like Microsoft, Google, and Meta to invest in their own generative AI tools and software, accelerating the adoption of AI technologies.